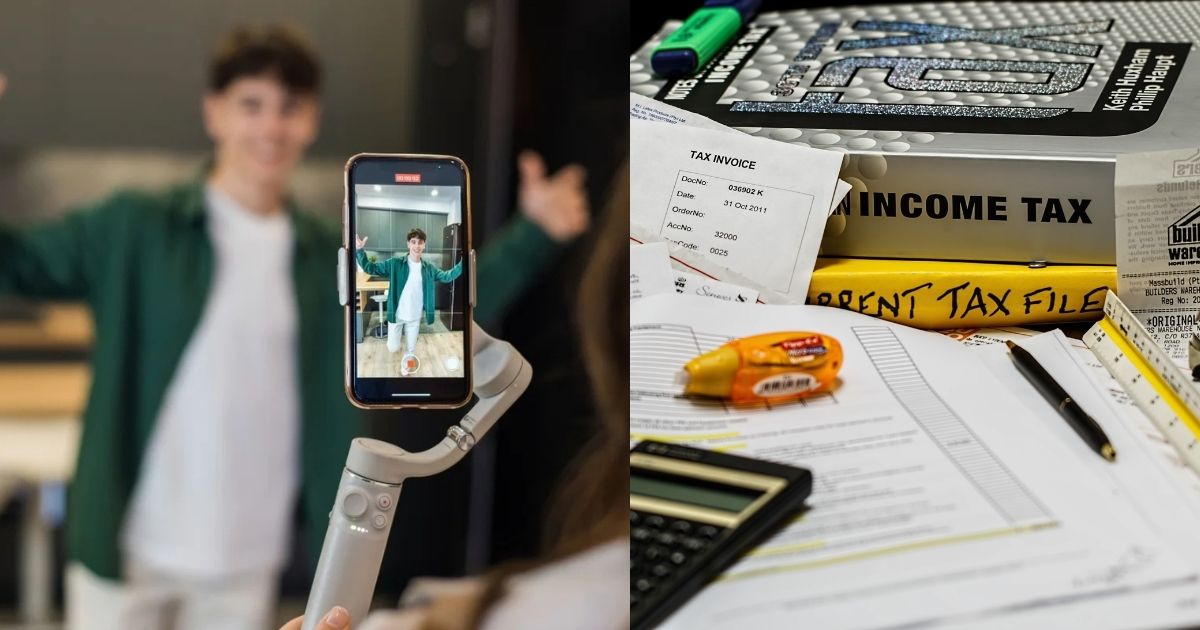

Just as social media grew, with it grew people’s dependency on it for news, suggestions and advice. What started with cooking and DIY suggestions went on to news recommendations too.

However, the limit was crossed when people started taking advice from social media platforms like tik-tok and Instagram for tax credits and refunds. This has led to hundreds of millions in fines by the IRS to taxpayers.

The Internal Revenue Service has recently posted a sharp warning to taxpayers- Stop taking tax advice from social media.

On September 8, 2025, the IRS announced that since 2022, it has imposed more than $162 million in penalties. These were composed against thousands of taxpayers who have filed false claims based on bad online tax advice.

James Clifford is the IRS Director of Return Integrity and Compliance Services. He has claimed that there have been several meritless claims being made on the tax papers that have been filed in the last few years. All these tax payers got this bad advice from the social media accounts and influencers.

People with “financial advice” accounts encourage people to apply for tax credits they do not qualify for, Among the most misused credits are the Fuel Tax Credit and the Sick and Family Leave Credit.

These credits are often portrayed as universal entitlements online.

Clifford has also claimed that these ‘influencers’ on Tiktok and Instagram often give wrong advice, which is often incorrectly portrayed online as universal entitlements. He went on to claim that these people suggest exaggerated eligibility to their followers and then urge them with minimal documentation.

They also teach taxpayers that IRS notices are not important and can be ignored, too. Under their suggestions, taxpayers end up filing amended returns with mistakes or incorrectly.

The IRS has reported that due to incorrect filing and wrongly claimed credits, they have imposed over 32,000 penalties in the last three years. All of these have been due to such schemes.

Each and every frivolous return can cause the taxpayers a civil fine of up $5,000 under IRS Code Section 6702. These could also have additional penalties or audits.

The IRS has released a few outlines that could serve as a warning for taxpayers to watch out for.

Taxpayers must remain aware of posts that claim ‘everyone qualifies”. There is no scheme or credit where everyone could qualify. Promises of fast refunds for taxpayers with ‘little documentation’ are most likely fraudulent too.

Any post that instructs to ignore IRS letters, or encouragement to use expired credits must be avoided at all cost IRS has time and again instructed taxpayers to not avoid any instruction or notice from IRS.

Anyone who spreads these claims through social media platforms and sometimes even in person are individuals without any credentials and must not be paid attention to.

Those who have fallen prey to these misleading claims will now face legal actions. There are not just penalties, but false claims also cause risk in delayed or denied benefits. Such tax filers bring upon themselves heightened scrutiny and possible audits, too.

https://youtu.be/X8uoVcMNHkw?si=zGYhqZpSjDecj8mY

Some taxpayers may even receive letters from the IRS where they will be asked to submit proof or documentation to support questionable credit claims.

The IRS urges everyone that if they suspect that they are being misled, they must take prompt action:

- Taxpayers can amend any return if they are claiming credits they are not eligible for. They can do so by using Form 1040-X.

- Every taxpayer must respond to any IRS notice or letter right away.

- Always rely on verified sources such as official IRS guidance, licensed tax professionals, or trusted institutions

- If one comes across any suspicious tax-related content or scams, they must report them immediately to the IRS.