According to Forbes, there are 2,781 billionaires in the globe as of April 2024. And their combined fortune has increased from $12.2 trillion in 2023 to over $14.2 trillion.

It can easily be said that all the power in the world is concentrated in the hands of these 2781 people. However, what happens when any one of these richest individuals dies? Where does the money go? Who inherits the power?

The answer is simple- in the family. Most of these billionaires will not like their hard-earned money to just get into the hands of strangers. Except few, many will like to keep it in the family.

Exceptions are always there like. One such exception is MacKenzie Scott. She is Jeff Bezos’s first wife and got a settlement of billions during her divorce.

Mackenzie has so far donated 19 billion dollars to several charities. Many billionaires have such clauses in their wills where a certain percentage of their total worth is donated to charity.

Rest, keep it simple and financially smart.

In The Family: The process of inheritance among billionaires is intricate. It depends on several factors. Some of these are personal relationships, financial maturity, and legal considerations.

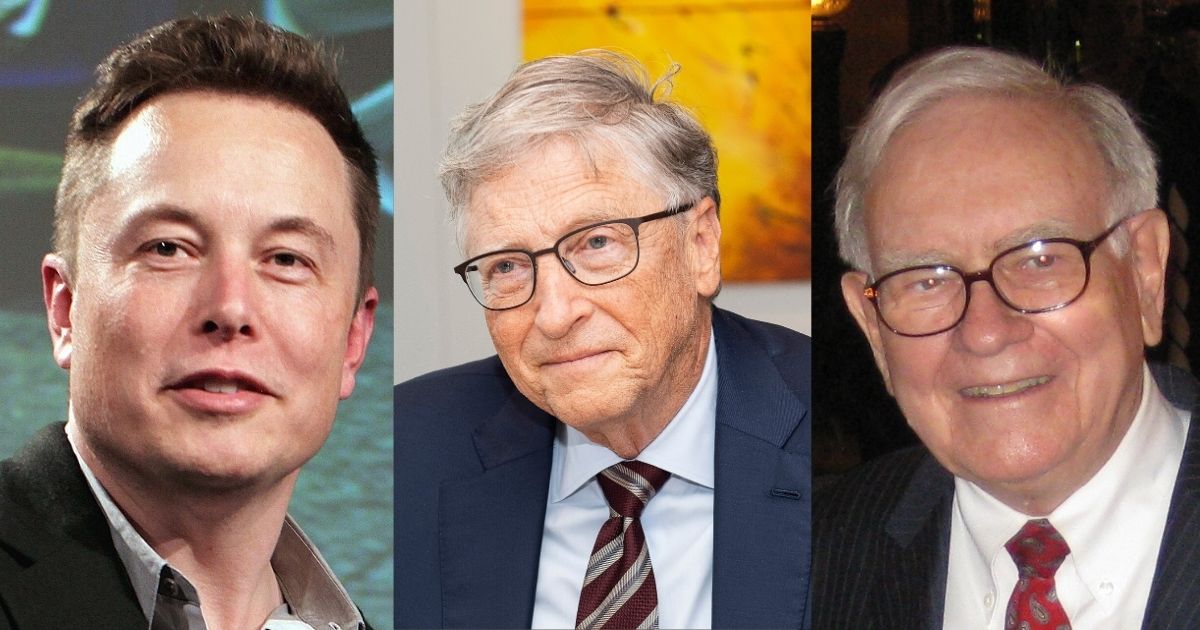

Bill Gates plans on leaving $10 million to each of his three kids as inheritance out of his $96 billion net worth – He’s set to give 99.97% of his fortune to charity.

— UberFacts (@UberFacts) February 2, 2019

Many billionaires utilize estate plans, trusts, and wills to transfer their money to their spouses, kids, or other heirs. By establishing family offices or company structures that guarantee financial stability for decades, some people build dynastic wealth.

For billionaires, inheritance planning is about more than simply money. It influences economic impact, corporate leadership, and family legacies for years to come. Therefore, they buy assets like land or buildings. However, asset transfer laws and estate taxes differ from nation to nation. Government actions also have an impact on inheritance.

Charity: Some billionaires have limited inheritance due to worries about fairness and wealth concentration. Proponents of modest inheritances, such as Bill Gates and Warren Buffett, make sure their children have financial security without going overboard. Others, like Jeff Bezos and

Elon Musk might transfer firm stock, enabling their descendants to continue running business conglomerates.

Elon Musk on his succession plan: “There are particular individuals that I’ve told the board look If something happens to me unexpectedly, this is my recommendation for who should take over. The board is aware who my recommendation is. It’s up to them of course.” pic.twitter.com/gk86HHx5Xe

— unusual_whales (@unusual_whales) May 28, 2023

Billionaires frequently use legal tools to escape taxes. Even in death, a billionaire would not like to pay taxes. There are several tools for them to choose from. Such as offshore accounts, charity organizations, and trusts to save estate taxes.

The Giving Pledge is a promise in which billionaires pledge to contribute the majority of their income to charity organizations. Some people give a significant amount of their wealth to philanthropy.

Today Warren Buffet announced in a public letter that he’s donating another $1.1B as part of his end-of-life planning. He says: “Father time always wins… To date, I’ve been very lucky, but, before long, he will get around to me.”

2 things interesting about this letter:

1.… pic.twitter.com/fwcuI10DFd

— Imade. (@ImadeIyamu) November 26, 2024

Set Up Trust: The ultra-rich sometimes set up trust funds for their kids or relatives in the family. Trusts might be set up to release money over time to ensure money is there for a longer period. This guarantees that money is used sensibly and eliminates careless spending.

Sometimes, they also create scholarships for worthy students and keep the money in funds. These are helpful for the education and well-being of underprivileged kids.

There are important social and economic effects to how billionaires divide their fortune after they pass away. Some people may argue that inheritance increases economic inequality. However, there may be others who think that charity and trusts are appropriate ways to use the money and improve society.

@moodewji proud of you brother as one of 14 new joiners of the Giving Pledge started by @BillGates and Warren Buffet Giving is receiving 🙌🏽 pic.twitter.com/MdUjYT7lVe

— Maria Sarungi Tsehai (@MariaSTsehai) June 2, 2017

In the end, billionaire inheritance is more than just financial gain. It influences company leadership, legacy, and the direction of the economy for future generations.