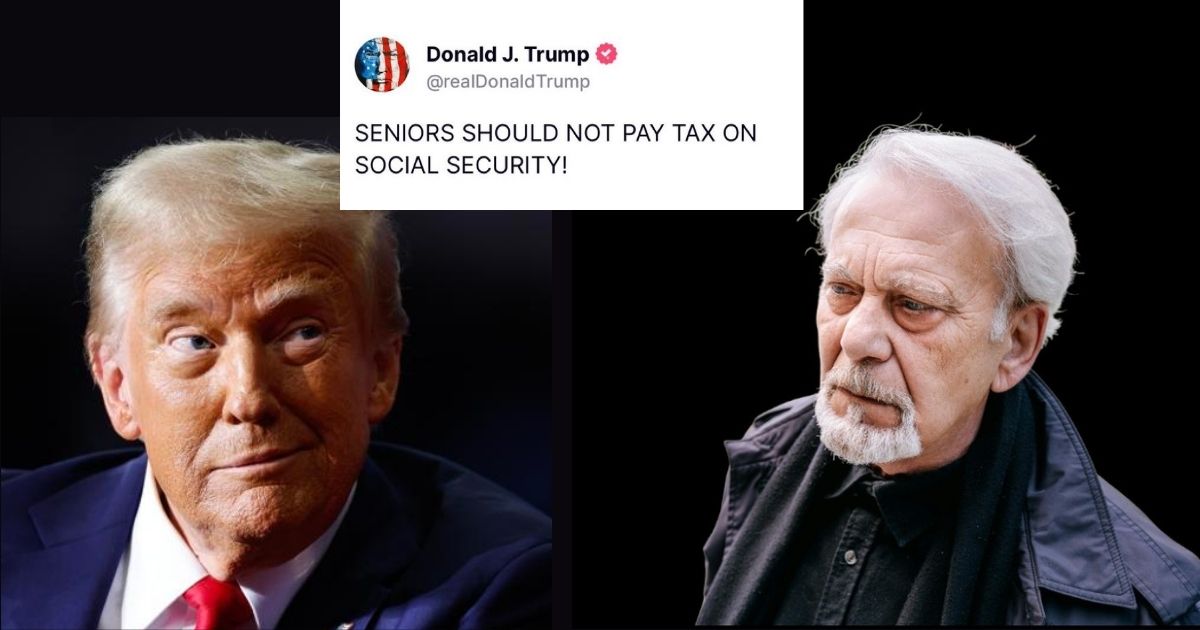

During his campaign for the second term, President Donald Trump said that he would eliminate the federal income taxes on social security benefits for seniors. This statement didn’t get left behind at the trial as he again reiterated this in the office. This promise got him the votes of the retiree community. This pledge was billed as a cornerstone of his retirement policy.

However, when Trump presented the One Big Beautiful Bill, the promise was conveniently forgotten. If there was any hope of it getting amended before the passing of the bill, that was lost too as the bill has already been passed. The bill talks about a temporary senior deduction rather than a full elimination of taxes.

The president didn’t make the social security income tax-free. However, the House offered a version where a $4,000 deduction was included in the bill for qualifying seniors. It is a stopgap measure, not a complete victory.

The Senate version of the bill increased the deduction to $6,000. It was for individuals earning up to $75,000 (or $150,000 if filing jointly) from 2025 through 2028. These deductions are certainly helpful, they still fall well short of Trump’s original pledge to scrap taxes on benefits altogether.

@cspanwj False and Misleading #Republicans are Calling Trump’s promise of NO Taxes on Social Security Benefits a $4KSenior Bonus🤔

When what they really will give you is $4KDeduction😫So if you get $40,000. In SS benefits you get to deduct $4K

That equals a $600. Tax Cut pic.twitter.com/Lcrr2SO4uI— COMMUNIST D🐶G (@Communist_Dog) June 18, 2025

There are many retirees who welcomed the extra deduction even if it could provide modest relief. It could still potentially reduce tax liability by a few hundred dollars for those within income limits.

But critics argue that these deductions and tax relief are insufficient in comparison to the full benefit of the tax repeal. High-income seniors may still have to pay taxes. The lower-income beneficiaries would see no added advantage.

This shift comes while there are rumors of social security being depleted by 2033-2035. A new report warns that without certain changes, the trust fund may be unable to pay full benefits by 2034. It would fall about 19% short if no legislative action is taken. Similarly, Medicare’s hospital insurance fund is also at risk of depletion by 2033.

🚨8 YEARS FROM INSOLVENCY: The #SocialSecurity and #Medicare Trustees released their annual reports today, showing:

➤ The Social Security OASI and Medicare HI trust funds will be insolvent in 2033

➤ Upon insolvency, retirees face a 23% benefit cut to benefits, and Medicare… pic.twitter.com/cQ9Zd3ka16— CRFB.org (@BudgetHawks) June 18, 2025

Trump has vowed to maintain full social security benefits. He has also opposed cuts. His administration also seeks to update the system. They want to eliminate paper checks and introduce online account access.

The partial deduction has been presented as a compromise to maintain federal revenue. The promise of completely eliminating the tax on social security would cost the government an estimated $100 billion annually, as per reports. It will be a substantial hit. Lawmakers do not want to get into it right now. Therefore, they have prioritized policies that are not related to revenue to keep the government functioning.

NEW: Trump just announced a new “no taxes on Social Security” policy.

It’s actually a $1.6 trillion cut to Social Security and Medicare in disguise.

The plan would cut Social Security benefits by 25% for the poorest seniors, and give the wealthiest retirees a 46% tax cut. pic.twitter.com/2CroJFjf5a

— More Perfect Union (@MorePerfectUS) August 2, 2024

However, seniors should take note that:

- Monthly Social Security benefits are not tax-free. Campaign promises are not a done deal. There is only partial deduction.

- For 2025–2028, a $4,000–$6,000 deduction could help some, particularly middle-class retirees.

- Federal trust fund issues could still impact long-term benefit levels, so this change shouldn’t be seen as a permanent solution.

Currently, the Senate is working to reconcile the House and Senate bills. Trump’s broken promise has frustrated his advocates. They are now calling for both long-term program stability and genuine tax relief for retirees.