Donald Trump has been vocal about everything else, but one thing and JPMorgan strategist Antonin Delair had to point it out. The president has bragged about his avid interest in the stock market for a long time now. Previously, he even talked about how strong stock rates reflect a growing economy. Then why is his recent social media activity doesn’t mention any of it?

Mr. Trump has been surprisingly quiet about the current state of the stock market since his second term in office began. He wrote about many things on his Truth Social and X but only mentioned the share market once.

View this post on Instagram

Delair took a deep dive into his social media wall, mostly on Truth Social, and analyzed over 126 posts made by Trump since election day. He concluded that the topic has “disappeared” from his social media activity, as he could only trace one post made recently on the stock market.

It comes as a surprise to many, as during his first time around, the president was “continuously” talking about US economic developments with a higher stock market and lower unemployment rate. Antonin noted that he was posting about creating a “new factory in a state.”

The JPMorgan strategist further explained that during his first term, Donald Trump made an estimated 23,073 tweets. According to Delair, out of those, around 156 or 57% mentioned the stock market, as quoted by AOL. The president heavily discussed market performance and its impact in those X posts. On the contrary, he had mentioned it only once on his social media since winning the 2024 election against Democrats.

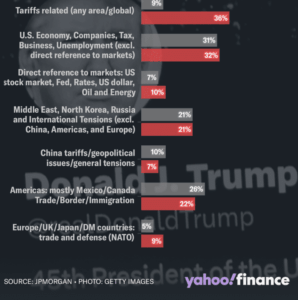

As it was hard to trace, Antonin Delair took a different approach. He assessed that out of 126 Truth Social and X posts, only 10% left an impact on the foreign exchange market. Since his reelection, Trump has mostly shared controversial takes on tariff benefits, debt ceiling, and government efficiency.

The JPMorgan strategist shared, “Hawkish tariff posts can trigger a broad dollar rally, but the dovish ones (tariff delays, for instance) impact mostly the concerned currency.”

View this post on Instagram

According to Yahoo! Finance, “The US budget deficit swelled to $1.83 trillion in fiscal year 2024, the highest amount outside of the COVID-19 period. Interest on federal debt exceeded $1 trillion for the first time.” In addition, from the prior year, the deficit last surged $130 billion or 8%, marking the third-highest federal deficit in the history of the United States.

Meanwhile, the Elon Musk-led Department of Government Efficiency is bringing unprecedented changes to government agencies. DOGE is cutting off federal jobs, shutting down programs that they and the Trump administration deem wasteful.

Salesforce (CRM) CEO Marc Benioff stated, “I think this is critical for us. We have to get to a balanced budget faster. This must be a bipartisan issue.” He added that the situation right now is “not a Republican or Democratic issue. It’s an issue that has not been as strongly embraced by the last several presidents.”

Perhaps it makes more sense why Trump hasn’t paid attention to the stock market and chose other matters to give hot takes on.