There are latecomers to every party, and there must be those who are fishing the line for filing their tax returns. The last date to do so is fast approaching.

No matter how late one might be, taxpayers still have a few days to file their taxes. People are encouraged to take steps to ensure their returns are filed appropriately. And they must do so on time, before April 15, 2025.

April 15, 2025, is the deadline to file the taxes. Those who fail will have to pay fines. However, there are resources available for people who are late in filing their returns.

People may be filing federal taxes, state taxes, or both. In any case, there are guidelines for everyone to file their tax returns.

Those who are filing their taxes must be aware of a few key points. Such as which taxes are filed and what is the last date. There are two kinds of tax returns people file. Federal and State taxes. April 15, 2025, is the due date for filing both the tax returns.

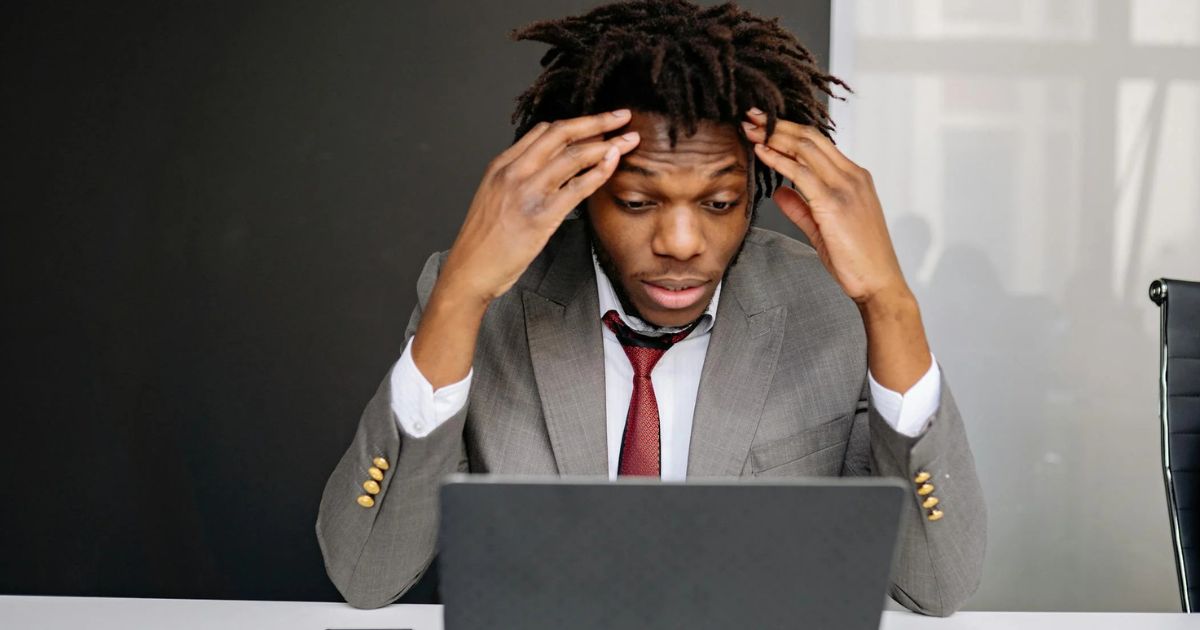

⏳ Last-minute filers, beware! Rushing through your tax return can lead to costly mistakes that delay your refund or trigger IRS penalties. 🚨

🚀 Need help? DM us now – we’ll make sure you file correctly & on time! 📩 pic.twitter.com/Ze512Wy2oT

— PrestigeBusinessEntp (@PrestigeBizEntp) April 5, 2025

The government offers an extension period to those who miss out on the deadline. An extension period of 6 months is provided. However, it is important to understand that the extension period is provided for document submissions. That means the last date to submit the document gets pushed to October 15. Any amount to be paid has to be submitted by April 15.

Those who fail to pay their taxes by the given date are usually fined. There are charges such as late filing fees and interest on the overdue taxes. Apart from this, there is also a late payment penalty. A penalty of 5% is usually charged on the unpaid tax. However, it also may go upto 25% in some cases.

However, citizens who are due to get tax refunds are not penalized by the IRS. Even then it is suggested to file on time.

⏳ One week left to file your taxes!

✔ Gather documents (W-2s, 1099s) 📂

✔ Check for mistakes ❌✅

✔ E-file for faster refunds 💻

✔ Need more time? File Form 4868 ⏳💡 DM us for tax help! pic.twitter.com/nMlBPGupbe

— PrestigeBusinessEntp (@PrestigeBizEntp) April 8, 2025

The IRS has a few suggestions for those who are running late to file their taxes. The department suggests filing tax returns online digitally. It is easier to calculate and process the forms online.

Paper filing can cause the processing to slow down. In those cases, even if someone has filed the return before April 15, the processing takes time. Tax returns may not be accepted.

Verification of bank accounts and other details are also important. No matter how sure you might be of your account number, check it again, and make sure the band name and your address are right, too. Otherwise, these errors can cause delays in tax refunds.

Those who couldn’t file their returns by April 15 can request an extension. Fill out Form 4868. However, one must be aware that this extends the filing period, not the payment period.

If you owe, don’t forget to pay your tax bill by the April 15 #IRS tax filing deadline, even if you’ve requested an extension until October 15 to file. Remember: An extension to file is not an extension to pay: https://t.co/aO7gmxudbN. pic.twitter.com/e2i8brp81P

— IRSnews (@IRSnews) April 9, 2025

After receiving an e-filed return, the IRS normally provides refunds in 21 days. The quickest delivery is guaranteed when a direct deposit is chosen. Once the return has been filed, taxpayers can track their refunds.

The IRS has a “Where’s My Refund?” tool. There is also the IRS2Go mobile app. These help in monitoring tax returns and tax refunds. Once the tax return has been filed, people can check the status of the refund. Those who have filed electronically can check within 24 hours. Those who have filed through paper will have to wait for some time for details to be updated.

Being proactive and knowledgeable is crucial as the tax deadline draws closer.