Rising living costs continue to stretch retirement budgets. Meanwhile, many older Americans are beginning to reassess just how much they depend on Social Security, and whether that reliance could be putting their future at risk.

For millions of retirees, Social Security is a crucial lifeline. But the average benefit stands at just $1,997 per month as of March 2025. It amounts to under $24,000 annually. It’s evident that relying too heavily on these payments may not be enough to cover even basic needs.

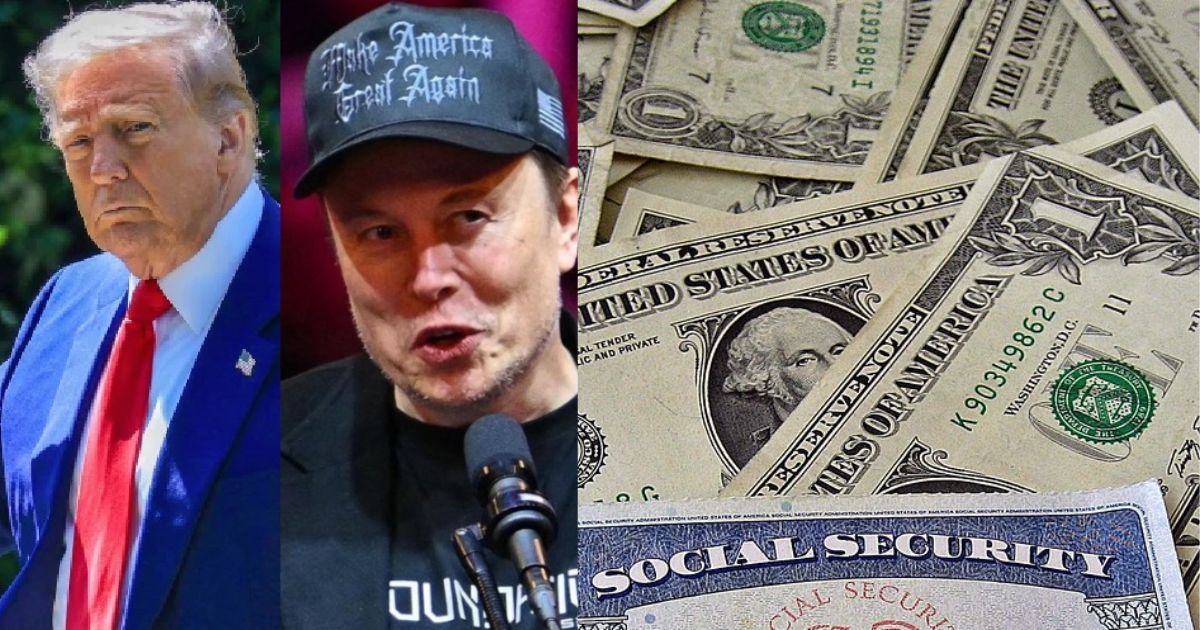

“I’ve been working on Social Security for 50 years. It’s gone through wars and pandemics.

It has never seen a threat like Donald Trump, Elon Musk, and Frank Bisignano, the nominee to be commissioner.

There’s never been a more important time to speak up.” – Nancy Altman pic.twitter.com/58rY0P7EZh

— Social Security Works (@SSWorks) May 5, 2025

Experts warn that those depending solely on Social Security are often left financially vulnerable. However, there are strategies that can help reduce that burden, especially for those nearing or already in retirement.

Cutting Costs Where Possible

One of the most immediate and important steps retirees can take is to reduce their living expenses. Many are already doing this. Downsizing homes, relocating to more affordable areas, or cutting off on non-essential spending.

But even small changes can add up. For example, retirees who no longer drive regularly may consider selling their vehicle.

That would help save big on gas, insurance, and maintenance.

Housing is the single largest expense for many older adults. Moving to a smaller home or a less expensive region may free up funds. That amount can be redirected toward healthcare or savings.

Exploring Flexible Work

Retirement is not the end of the career anymore. More Americans are returning to the workforce, at least part-time. A flexible or remote job may not only offer supplemental income but also help retirees stretch their savings further.

This doesn’t have to mean returning to a 40-hour workweek. Many retirees are pursuing passion projects, freelancing, or working limited hours in roles that suit their interests.

Donald Trump has a new Social Security Commissioner.

I’m pressing for answers on nearly 200 unanswered questions about his administration’s attempts to cut Americans’ benefits. pic.twitter.com/RYznRXRdhB

— Elizabeth Warren (@SenWarren) May 8, 2025

Even modest earnings can offset the gap between monthly expenses and Social Security income.

Accessing Additional Government Support

In addition to Social Security, there are other government programs available that can provide financial relief. Low-income retirees may qualify for benefits like:

- Supplemental Nutrition Assistance Program (SNAP), which helps cover food costs.

- Medicaid, which provides healthcare coverage to low-income individuals.

- Supplemental Security Income (SSI), a benefit for seniors, blind, and disabled individuals with limited income and resources.

In a powerful statement, Speaker Emerita Nancy Pelosi says Donald Trump is “not a patriot” over his attacks on the U.S. Constitution, Social Security, and Medicaid. Trump will absolutely hate this so make sure you repost it right this very minute. #DontFuckWithMedicaid pic.twitter.com/YSEeVcwpk6

— CALL TO ACTIVISM (@CalltoActivism) May 6, 2025

These programs, often administered at the state level, can play a big role in easing financial pressure. Seniors are encouraged to explore available options through their local social services office or state websites.

Delaying Retirement

For those still in good health and capable of working, delaying retirement can be a powerful financial strategy. Waiting until full retirement age, or even up to age 70, can help increase monthly Social Security payments.

According to financial analysts, even a delay of a few months can lead to a measurable boost in lifetime benefits. And, working longer means tapping into retirement savings later.

It will help preserve assets for the long term.

A Balanced Approach

There may be no single solution to easing Social Security dependence, but combining several of these strategies could bring greater financial stability. For those still a few years away from retirement, now may be the time to build alternative income sources, through IRAs, 401(k) plans, or other savings vehicles.

As the conversation around retirement security keeps growing, financial advisors stress that knowledge and preparation is the key.

This is Sen. Thom Tillis (R-NC). He voted against the Social Security Fairness Act – which President Biden just signed into law – that gives benefits to over 3 million retirees. He’s up for re-election in 2026.

RETWEET to let North Carolina that he voted against Social Security! pic.twitter.com/qlOJMJONCR

— Protect Kamala Harris ✊ (@DisavowTrump20) May 6, 2025

Social Security’s future is still uncertain. At this stage, diversifying income and planning ahead can provide a greater sense of control in an unpredictable economy.