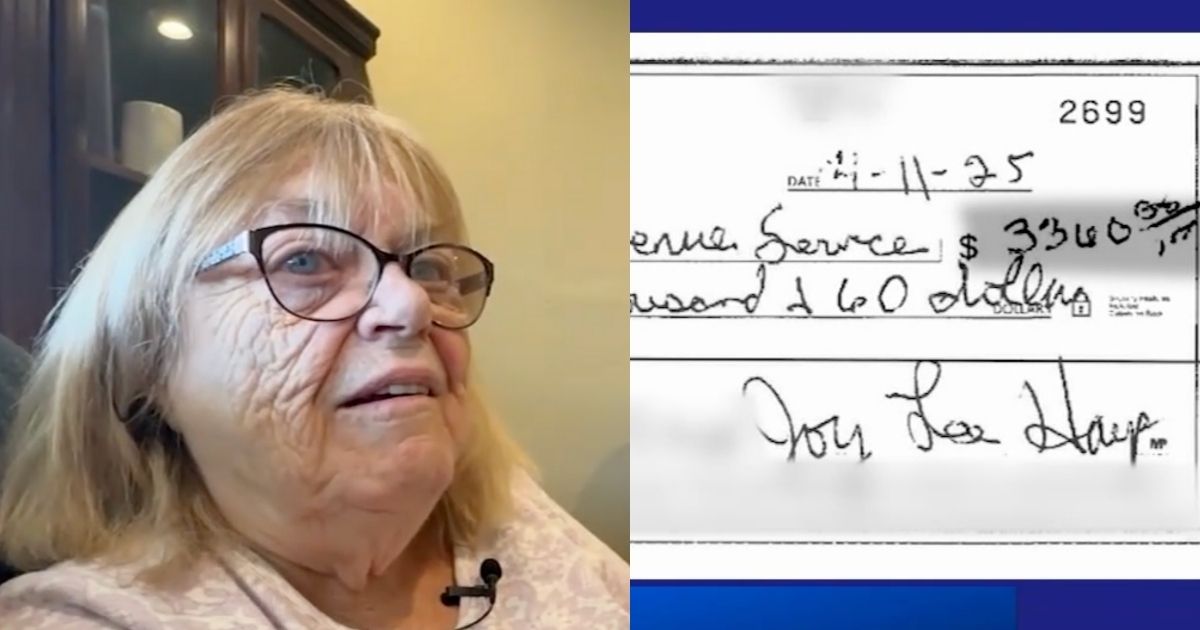

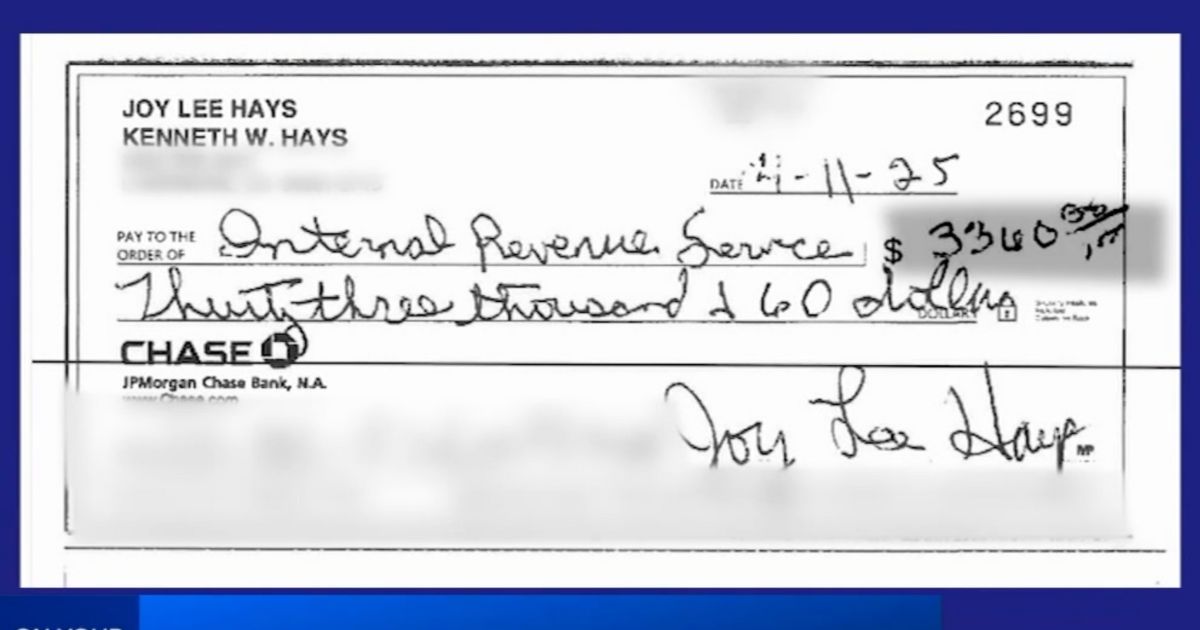

Joy Hays and her husband, Kenneth, would have never imagined that getting ahead of their tax obligations would cost them this many headaches. The California couple decided to pay their taxes soon and sat down to calculate how much they owed the IRS. The calculations told them it was 3,360. However, what they didn’t know was that a tiny mistake would cost them so much emotional and financial trouble.

What happened was instead of writing “three thousand three hundred sixty dollars,” Joy accidentally wrote “thirty-three thousand + 60” in the written portion of the check.

It was a minor error, but this would become their nightmare.

When the check reached the IRS and the automated system tried to process it, the check bounced. And of course it did because of insufficient funds. But the agency, rather than contacting Hays, kept trying and trying and trying.

What was astonishing was that the IRS did not confirm with the couple about the check being bounced or the plausible error; instead, they penalized Hays for not paying their taxes on time. And issued them a fine of $661.

Since then, the efforts to clear up this mistake and miscommunication have only caused more headaches to the couple.

‘My god!’: Here’s how a California couple almost paid $30,000 more on their income taxes https://t.co/dMcRloFZ2F

— ABC11 EyewitnessNews (@ABC11_WTVD) July 7, 2025

It’s not that Joy or Kenneth have not tried to rectify the mistake. On the contrary, Joy has spent more than 6 hours on hold for a month trying to reach the IRS in an attempt to talk to a live agent. They have made multiple attempts to explain what has happened, but all they received from the agency is silence with no relief in fine.

Tax attorney Chris Housh has chimed in with his views, and he explains the Hays situation is neither unique nor has it happened for the first time. He explained the IRS payment and return processing units work independently and do not communicate in matters of cases.

This means once the check has been separated from the documents, it was most likely reviewed by the automated system and no human involvement is needed to double-check the error or the issue, Housh told ABC 11. The Hays’ situation isn’t unique. As he explained, the IRS’s payment and return processing units operate independently. This means the check that once separated from the tax paperwork was likely reviewed by automated systems without human oversight. “A human has probably not looked at what the actual situation is, ” Housh told ABC 11.

“Nobody has double-checked the two items together.” He said

This breakdown is due to the border issues plaguing the internal system of the IRS. After a mass layoff of almost 25% of its workforce in recent years, there has been a severe lack of working hands at the agency. These layoffs came after budget cuts and mandatory staff reductions. As a result, the core function of the IRS has been hindered.

This includes payment processing. Almost all functions have become automated, which has caused many examples where minor issues fall through the cracks and become major problems for the taxpayers. A live agency could have easily corrected these minor issues, but right now, there is no one.

TRUMP ADMINSTRATION CUTS 25% OF IRS WORKFORCE WITH BUYOUTS AND FIRINGS, SLASHING NEARLY 26,000 STAFF MEMBERS pic.twitter.com/HBEvvWPHNq

— 🦋Simi🦋🇺🇸 (@Simi28_) July 23, 2025

The Hays’ ordeal is a cautionary tale for many in more ways than one. It not only shows how rigid the IRS functioning has become with no place for human error, but it also warns people of not making the smallest of mistakes while writing checks. Every monetary error can cause a significant headache.

Beyond highlighting the rigidity of IRS systems, it also underscores how a minor check-writing mistake can spiral into a significant financial headache. Experts recommend triple-checking all checks before submitting them, particularly for large or critical payments like taxes.

Taking an extra minute to review payment details could save hours of stress and hundreds in penalties.