73 million people currently receive Social Security from the government. As the number of people applying for the payments has been increasing, there’s pressure on the administration to fulfill that.

According to current statistics, the funds may run out by 2033, making it impossible for retired folks to survive without payments.

Lately, there have been changes in the social security system, starting from reducing staff or changing the official identification platform. The Trump administration has been behind the changes while also handling immigration deportation. They believe social security has been going to the wrong people.

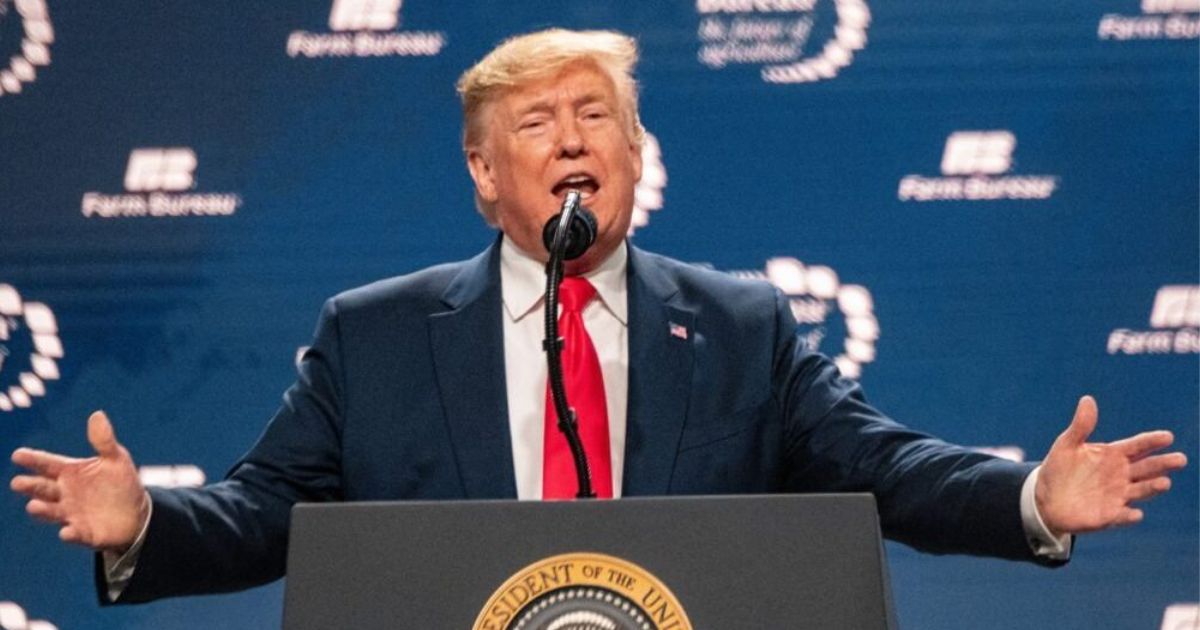

The recent update is that Donald Trump wants to remove taxes from Social Security checks and ensure that people receive all their benefits. But how will that work out for the administration in the long run?

One way we see the impact is by depleting and putting more pressure on Social Security’s long-term cash flow, which is already struggling. This may appease the retired people, but what about the people who will not be able to cash in their social security later on?

.@POTUS: “In the coming weeks and months, we will pass the largest tax cuts in American History—and that will include No Tax on Tips, NO Tax on Social Security, and No Tax on Overtime. It’s called the one big beautiful bill…” pic.twitter.com/SRwaWoY9gZ

— Rapid Response 47 (@RapidResponse47) April 29, 2025

However, removing taxes from the payments will weaken the financial foundation of the whole system. The people who have elected Trump have high hopes for the reformation of the system for their betterment. With this, they may feel the payments will be bigger without the taxes, but what happens when the cash runs out?

So this idea could backfire if not thought through, as the current projection shows only an eight to ten year survival of the program. Over the last 40 years, the funds have been in deficit to be available for the next 75 years. Even with the $23.2 trillion funding, they don’t seem to be confident in providing it for all. So, due to bankruptcy and limited reserves, the system may collapse. Plus, there are cost of living adjustments in the payments, further depleting the reserve.

So far, Donald Trump has already made several changes, and some people feel that this could impact his future voters. The staff was reduced by seven thousand as Trump signed the orders. Moreover, he stopped the overpayment and changed the recovery rules set by Biden. Apart from this, he has nominated Frank Bisignano to be the new commissioner.

.@PressSec: As for the tax provisions in the reconciliation bill, @POTUS has made his priorities incredibly clear: No tax on tips for our service workers, no tax on Social Security for our well-deserving seniors, no tax on overtime…

“Anyone who opposes this bill will be… pic.twitter.com/UpJNw6uyBu

— Rapid Response 47 (@RapidResponse47) May 9, 2025

All these changes are already changing the system and leaving people in panic. The change of no taxes on social security may make people believe it to be positive. But in reality, it could cut down their own payments later. Over the years, the tax has been applicable on 10% of retired people who receive the checks. This is adjusted as per their gross income and other benefits.

Currently, more than half will be under the tax bracket if we adjust their high wages and cost of living. So, removing taxes altogether from their benefits will leave the government’s reserve dry.

If Trump really amends the act to get rid of the tax on benefits, the increase in take-home salary will help seniors with their usual expenses. Furthermore, it will nullify the three sources of funding that keep the program running. This short-term plan to boost the payments might just cause unintentional damage to the whole system.